Manufacturing Growth Forecasts Revised by Interact Analysis

Interact Analysis has made significant revisions to its growth forecasts for the manufacturing sector across key global regions including the U.S. and Europe. The updated projections indicate that recovery in these areas will now begin in 2026, a year later than previously anticipated.

Reasons Behind the Revised Forecasts

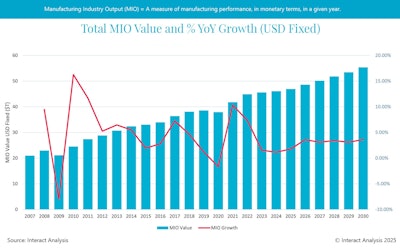

The adjustments are primarily attributed to new tariffs imposed by former U.S. President Donald Trump. Interact Analysis’s Manufacturing Industry Output (MIO) tracker shows a notable slowdown in growth, with the U.S. forecast slumping from a potential 4% to just 0.9%.

The downgrade in the U.S. manufacturing outlook can be traced back to the sector’s heavy reliance on imports needed to sustain its largest industries. This vulnerability has a cascading effect on growth predictions.

In Europe, the Eurozone’s manufacturing is projected to contract by 2.4% in 2025, largely due to the dependency of major industry players on the U.S. as a crucial export market.

Contrasting Growth Prospects in Asia

In stark contrast, Interact Analysis forecasts an overall growth of 2.7% in Asia’s manufacturing sector, with China expected to lead the way with a robust growth estimate of 2.9%.

Interact Analysis Growth Projections

The Machinery Sector’s Outlook

The impact of new trade barriers is particularly pronounced in the machinery sector, where the U.S. has increasingly relied on imported parts and components. This has compounded the negative effects on the projected growth of manufacturing.

In Europe, machinery exporters, notably in Germany and Italy, are bracing for reduced demand from the U.S. Nevertheless, Asian economies are likely to see growth in their machinery sectors, provided that stable trade agreements are reached.

Expert Insights

Jack Loughney, Lead Analyst for the MIO Tracker, commented on the situation, stating, “Overall, the growth that was expected in 2025 is not achievable due to the ongoing tariff policies, but there’s hope for some stabilization in 2026. Trump’s tariffs have dampened expectations for what was projected to be a strong year for global manufacturing; as a result, we have downgraded many of our forecasts given the rapidly shifting landscape and the persistent threat of a tariff war.”